Navigating the Emerging Financial Storm: AI, Crypto, and Banking

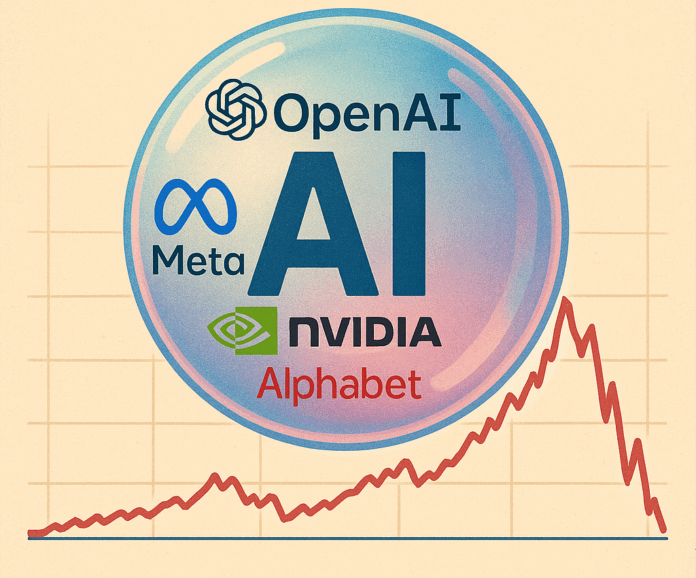

As investment excitement surges in AI and cryptocurrency, experts warn of looming financial pitfalls reminiscent of the Dotcom era. The intertwining of these sectors could lead to a catastrophic failure, affecting the entire financial system.

Key Insights:

- Self-Referential Financing: Major tech firms are increasingly financing each other’s projects, creating a bubble of mutual dependence.

- Critique of Overconfidence: Industry leaders express concern about a collective complacency ignoring foundational flaws—parallels drawn to past financial crises.

- Potential Repercussions: If a crash unfolds, expect a ripple effect impacting banks, hedge funds, and investors alike, exacerbated by lax regulations.

Future Landscape:

- Winners and Losers: Emerging sectors like vertical software and data-driven enterprises could thrive post-crisis, benefiting consumers in the long run.

- Risks and Opportunities: Economists warn that a larger financial meltdown is possible, necessitating urgent regulatory reassessments.

🚀 Let’s discuss your perspectives on this evolving landscape! Share your thoughts below!