The Tug-of-War Between Wall Street and Silicon Valley: A Cauldron of Financial Risks

As Wall Street and Silicon Valley navigate a transformative landscape, their strategies seem at odds—but one growing trend unites them: precarious credit deals. Here’s what you need to know:

- Convergence of Interests: Tech firms strive to become banking apps, but both sectors are increasingly engaging in risky financing, inadvertently paving the way for potential financial crises.

- The Rise of Private Credit: With over $1.6 trillion in assets, private credit firms operate outside traditional regulations, raising alarms among financial experts.

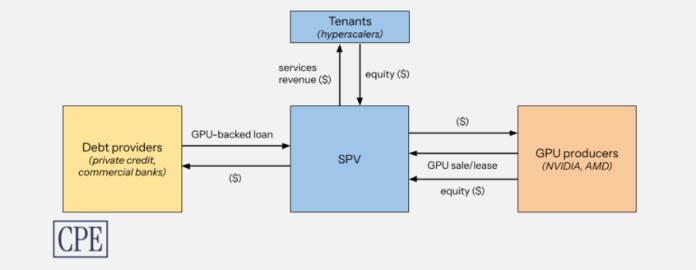

- Speculative Investments: Companies like Meta are leveraging Special Purpose Vehicles (SPVs) to finance data centers—a risky proposition given the rapid depreciation of technology.

Experts warn: if the AI bubble bursts, average investors could bear the brunt of the fallout.

🚀 Engage in the conversation! Share your thoughts on the evolving relationship between tech and finance. How should we address these threats?