The Impact of AI on Software Revenue and Private Lending

As AI technologies evolve, the landscape for software and private lending is facing unprecedented challenges. The cascading effects extend beyond software revenue, affecting debt portfolios significantly. Here are key insights:

-

Market Trends:

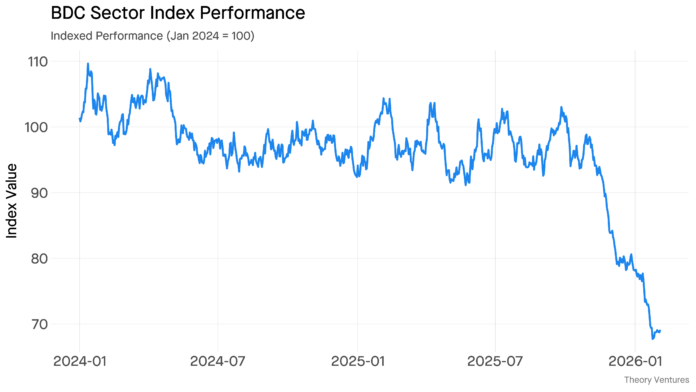

- BDC assets reached $475 billion in Q1 2025, with software comprising 23% of Ares Capital.

- Shares of Blue Owl, Ares, and KKR fell over 9% recently as AI disrupts revenue models.

-

AI Disruption:

- UBS estimates that 35% of BDC portfolios will feel AI’s impact.

- The new AI capabilities are outperforming traditional software, leading to alarming shifts.

-

Infrastructure Leverage:

- Major players like Oracle and Blackstone are heavily investing in AI infrastructure, but reliance on debt is high.

As we navigate this shifting terrain, understanding these dynamics is crucial for industry professionals and investors.

Join the conversation! Share your thoughts on AI’s impact on software and lending below!