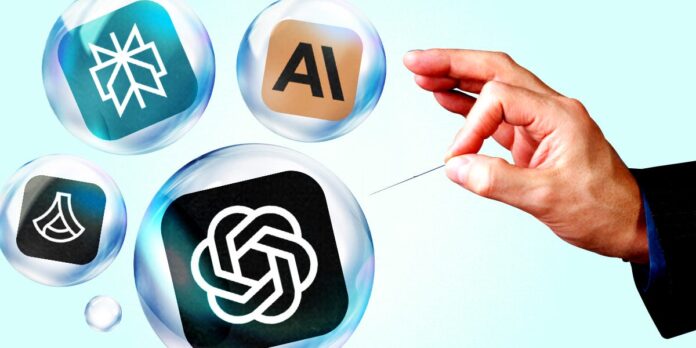

As valuations for AI companies skyrocket, concerns arise over the proliferation of special purpose vehicles (SPVs) designed to capitalize on investor FOMO. SPVs allow investors to pool funds for one-time deals, but many feature excessive fees, opaque structures, and complicated intermediaries, raising red flags about potential scams. Prominent venture capitalists, like Bill Gurley, warn that these vehicles can lead to “risk-seeking behavior” and may not align with the interests of genuine investors. Companies like OpenAI and Anthropic have cautioned against unauthorized SPVs, which could render investments worthless. While some SPVs provide legitimate access to high-demand tech, the trend reflects a chaotic market where retail investors may unknowingly incur significant losses due to a maze of hidden costs. Experts urge caution, as excessive layering of fees could diminish returns significantly, leading to fears of a bubble in the AI investment landscape.

Source link

Share

Read more