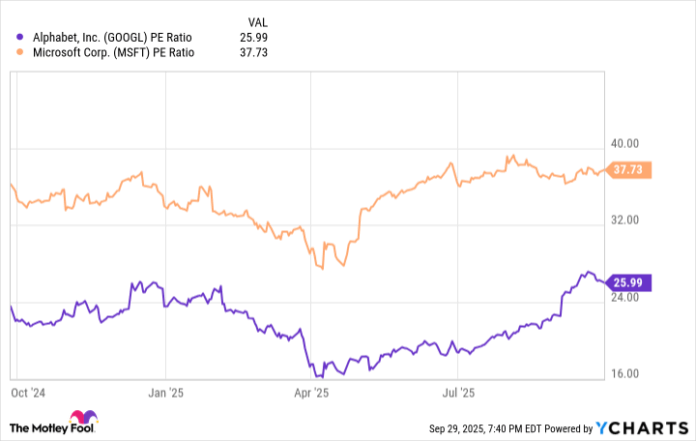

Alphabet’s AI model, Gemini, recently achieved a groundbreaking win in an international programming competition, marking a significant step towards artificial general intelligence (AGI). This milestone underscores the evolving landscape of AI, reminiscent of IBM’s Deep Blue victory in 1997. As AI technology advances beyond basic tasks to solving complex problems, the potential for market disruption grows, particularly in sectors like semiconductor manufacturing, where companies like Nvidia thrive. Alphabet’s financial strength, bolstered by a robust free cash flow of $66.7 billion, positions it well to invest in advanced AI systems. Despite Gemini’s success, Alphabet’s stock remains undervalued compared to rivals such as Microsoft, indicating an opportune moment for investors. As the AI sector continues to expand, growth potential exists not just for Alphabet but also for other leaders like Nvidia and IBM. Investing in these companies could yield significant returns amid the ongoing AI revolution.

Source link

Share

Read more