NVIDIA, the world’s most valuable publicly traded company with a valuation of $4.24 trillion, released record-setting Q2 2026 earnings, reporting a 56% sales surge to $46.74 billion. Despite falling short of Wall Street expectations, the chipmaker’s sales growth outpaces the average tech sector growth of 10%. NVIDIA anticipates a significant long-term AI infrastructure opportunity, potentially worth $3-$4 trillion, led by its new Blackwell architecture. The company’s revenue growth projections for the upcoming quarters remain robust, with an estimated 42% increase over the next year. However, stock prices fell 3% post-earnings amid broader market declines and geopolitical uncertainties affecting its China market, particularly regarding the $4 billion H20 chip revenue. NVIDIA expects Q3 revenue of $54 billion, with gross margins around 73%. Additionally, it continues to return capital to shareholders, having distributed $24.3 billion thus far and launching a new $60 billion buyback program, affirming its strong growth trajectory.

Source link

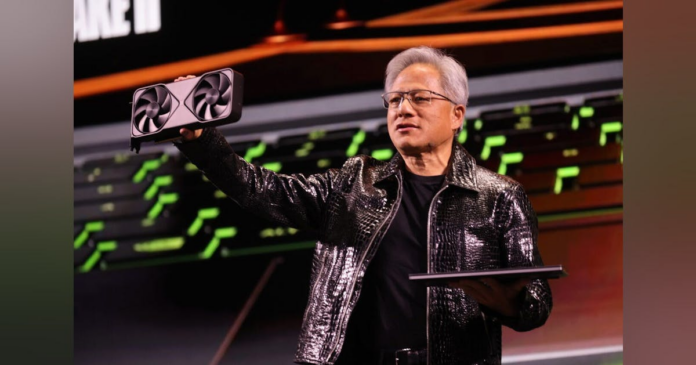

NVIDIA Anticipates a $3–$4 Trillion AI Market, Ushering in a New Era of Infrastructure Development

Share

Read more