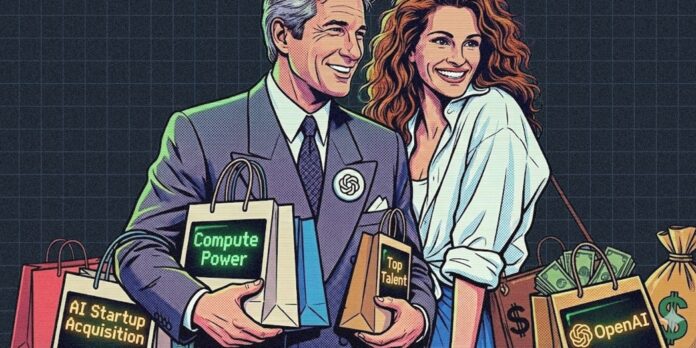

OpenAI is launching an extensive infrastructure investment initiative, allowing partners like SoftBank, Oracle, and CoreWeave to absorb nearly $100 billion in financing costs. This staggering amount mirrors the debt of major corporations, such as Volkswagen and AT&T. Analysts warn that Oracle might require an additional $100 billion over the next four years to uphold its commitments to OpenAI. While OpenAI sidesteps hefty construction bills, it faces the challenge of paying significant service fees to its partners. HSBC predicts OpenAI could generate $213 billion in annual revenue by 2030, but this falls short of its projected yearly costs by around $70 billion. This financial gap may compel OpenAI to secure further funding or renegotiate its contracts. Meanwhile, Alphabet, the maker of Gemini, boasts nearly $100 billion in cash and a strong cash flow, making it a more attractive investment option compared to OpenAI’s uncertain financial outlook.

Source link

Share

Read more