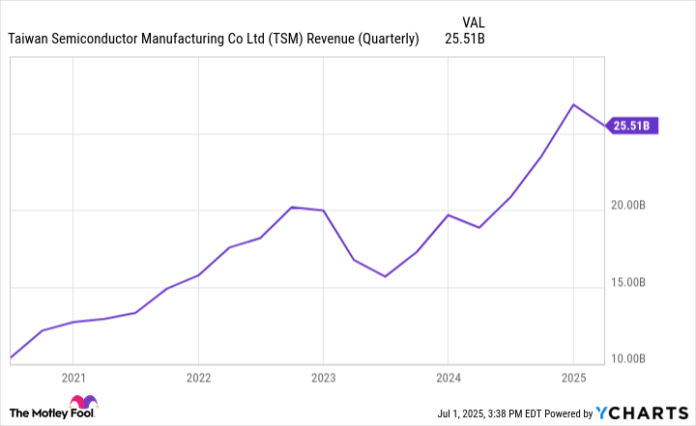

Taiwan Semiconductor Manufacturing Company (TSMC) is a leading player in the AI chip market, producing the majority of high-performance AI chips that accounted for 59% of its revenue in Q1 2025. With revenue increasing 35% year-over-year to $25.5 billion, TSMC expects continued growth, driven by demand for AI technology. As the world’s largest semiconductor manufacturer, TSMC fabricates chips for major companies like Apple and Nvidia, solidifying its position in the AI ecosystem. Although geopolitical tensions with China pose risks, TSMC is expanding operations globally in the U.S., Germany, and Japan to mitigate these concerns. Despite trading at a premium, TSMC is considered a strong investment opportunity, particularly for long-term holders. However, The Motley Fool’s Stock Advisor has identified 10 alternative stocks with potentially higher returns. For investors looking into AI-related stocks, TSMC remains a pivotal player, crucial for the technology’s advancement and sustainability.

Source link

Share

Read more