Unlocking Profits in the AI Era: Insights on Broadcom’s Strategy

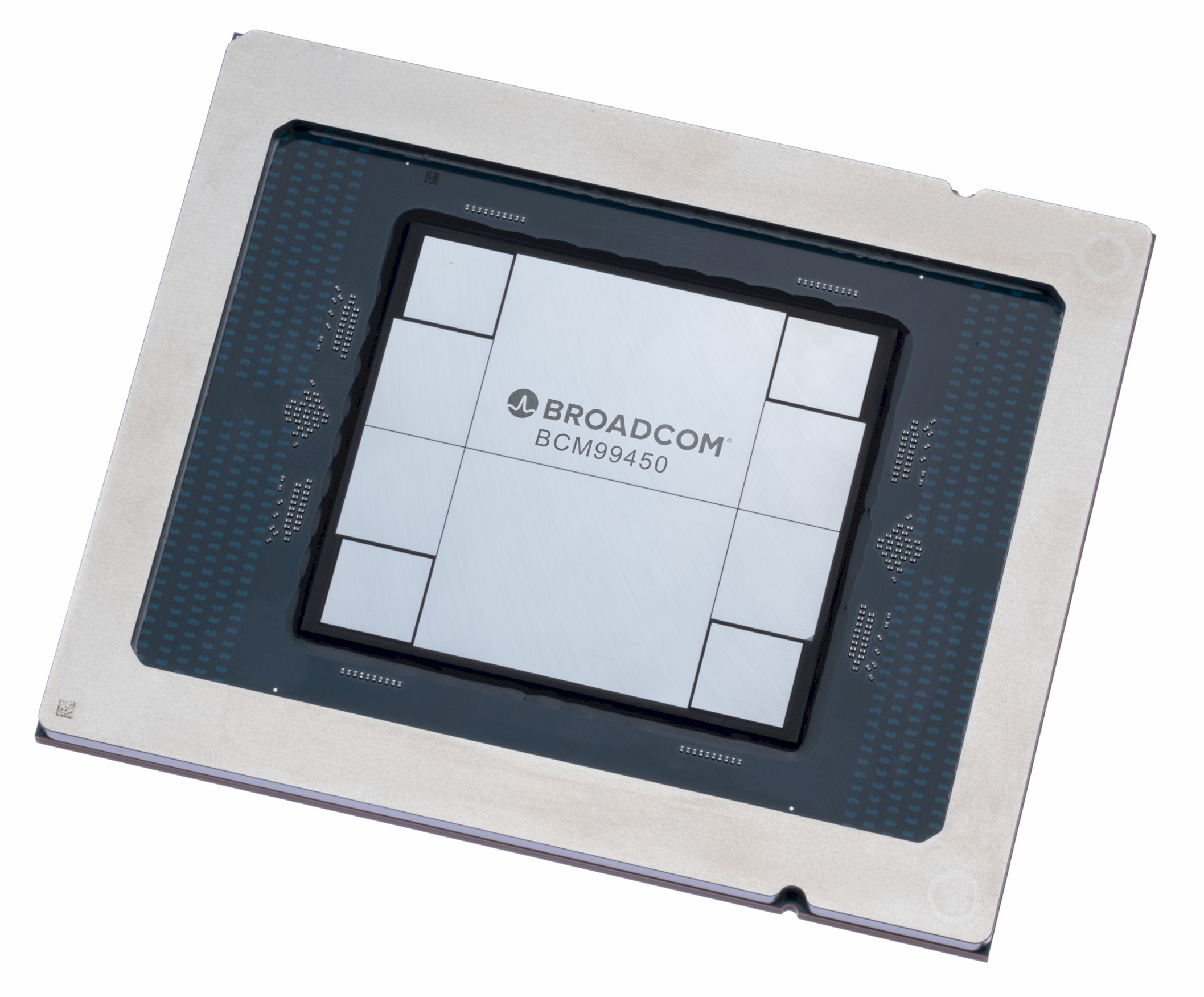

In today’s rapidly evolving AI landscape, few companies have successfully capitalized on the GenAI boom—Nvidia and Taiwan Semiconductor Manufacturing Co. are at the forefront. However, others, including Broadcom, face a dilemma: pursuing AI expansion while grappling with margin dilution.

Key Insights:

-

Current Profit Dynamics:

- Broadcom reported $18B in sales for Q4 2025, reflecting a 28% y-o-y growth.

- Operating income surged by 62% to $7.51B, driven by its profitable software legacy from Symantec and VMware.

-

AI Market Landscape:

- Broadcom’s shift to AI system integration increases operational responsibilities while reducing profit margins.

- An impressive $73B AI backlog looms, with expectations to double AI chip revenues by Q1 2026.

Conclusion:

As Broadcom navigates this complex AI terrain, understanding both opportunities and risks will be crucial for sustained growth.

📈 Stay informed and share your thoughts on Broadcom’s approach to AI!