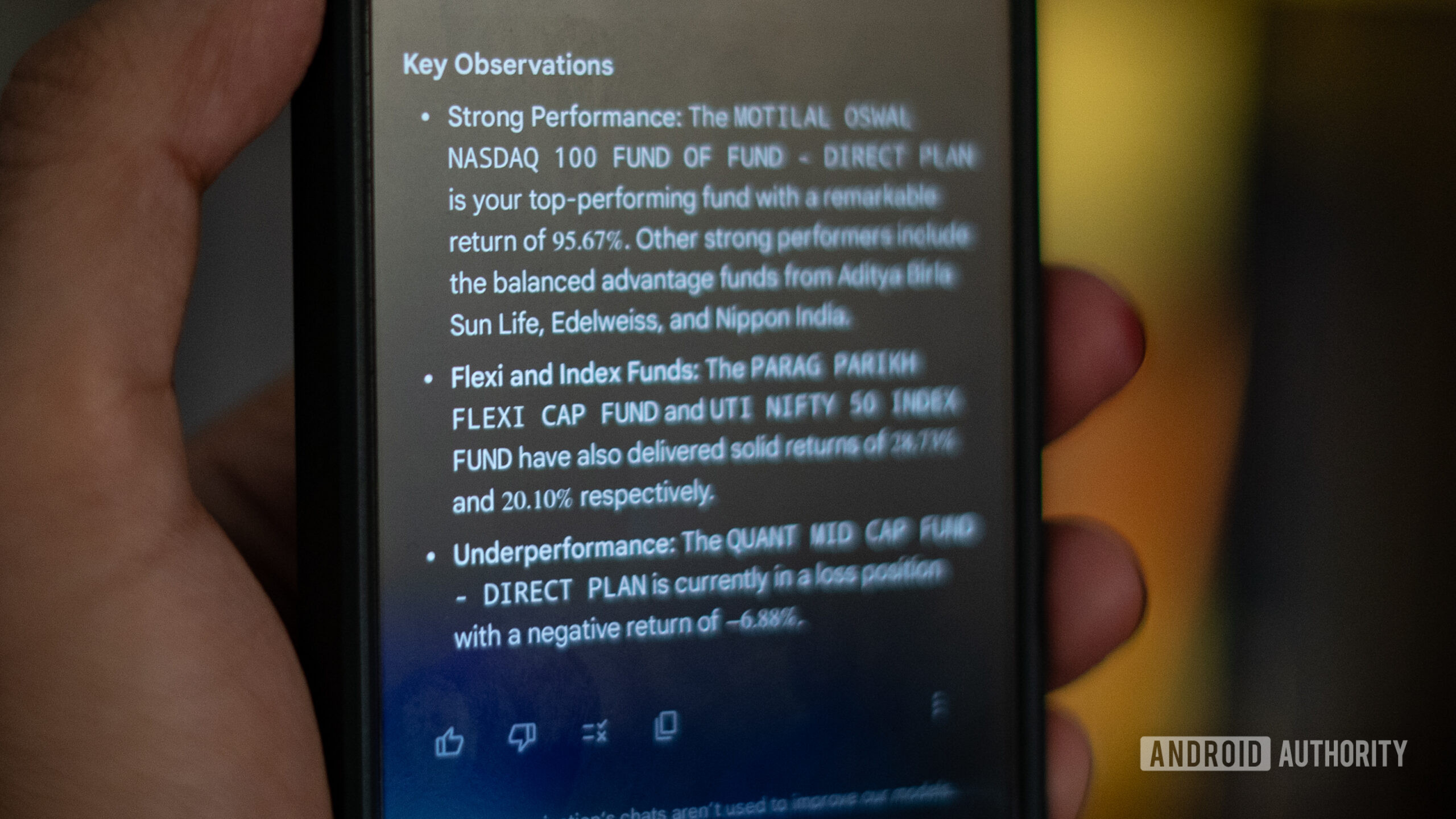

Dhruv Bhutani from Android Authority explores the potential of Google’s Gemini AI as a tool for investment analysis. By feeding Gemini data from his portfolio, including account statements and mutual fund disclosures, he aimed to see if it could provide valuable insights, identify risks, and suggest effective investment strategies. With clearly defined goals—favoring aggressive, long-term growth—he found that Gemini effectively analyzed his holdings, identified overlaps, and recommended portfolio restructuring to optimize returns. The AI suggested reallocating investments to outperform category averages while maintaining a diversified strategy. Although Gemini’s insights outperformed his wealth manager’s recommendations by nearly 1%, it’s crucial to remember that AI lacks real-time data and shouldn’t replace professional advice. Ultimately, while Gemini accelerates the analysis process, a skilled wealth manager’s market insight remains invaluable. This experiment highlights AI’s role in enhancing investment understanding, making it a useful tool for savvy investors during portfolio rebalancing.

Source link