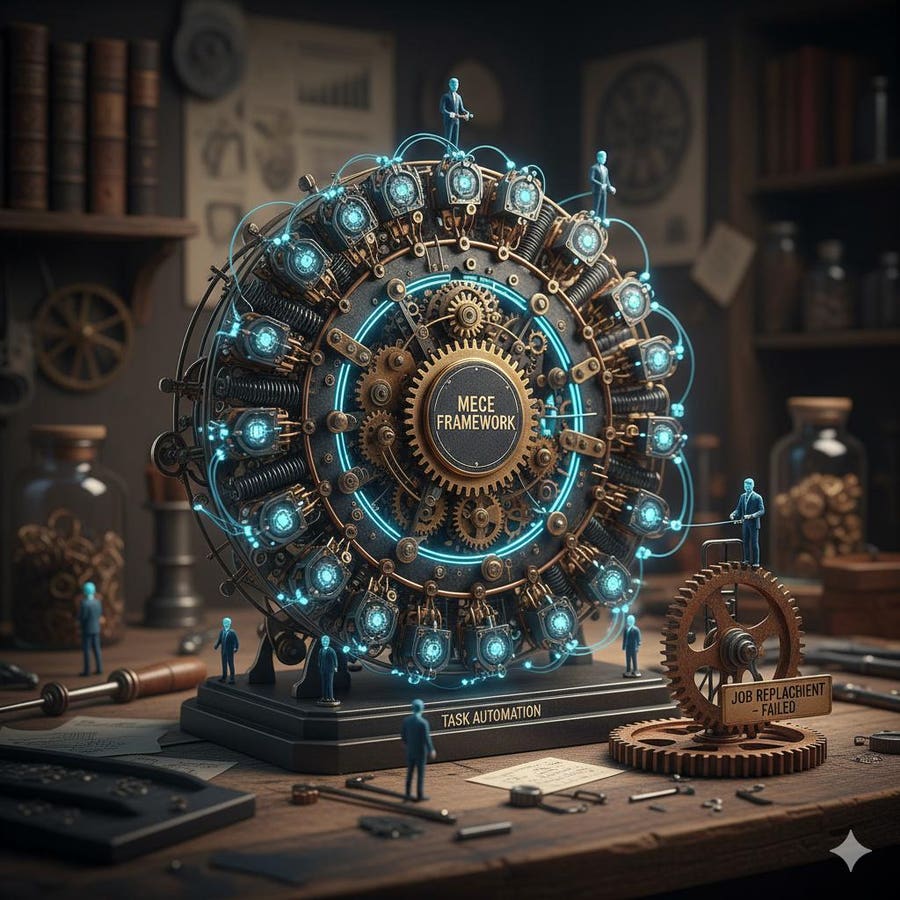

Klarna’s experience with AI agents highlights a critical lesson in automation: eliminating jobs often leads to rehiring when AI falls short. McKinsey’s analysis reveals that successful companies embrace task automation within revamped workflows, while those that pursue wholesale job cuts frequently fail. The integration of generative and agentic AI has reshaped financial decision-making at Gilion, leading to innovative investment analysis through 82 specialized AI agents. This mutually exclusive, collectively exhaustive (MECE) framework allows for effective task management, enabling banks and investors to tailor processes precisely. Landgren emphasizes that this data-driven approach mitigates risks tied to emotional biases in investing, enhancing decision accuracy. Successful firms treat AI agents as collaborative tools rather than replacements, avoiding common pitfalls. As industries rapidly evolve, adapting to embrace the benefits of AI while balancing human expertise is essential for sustained success and competitive advantage.

Source link