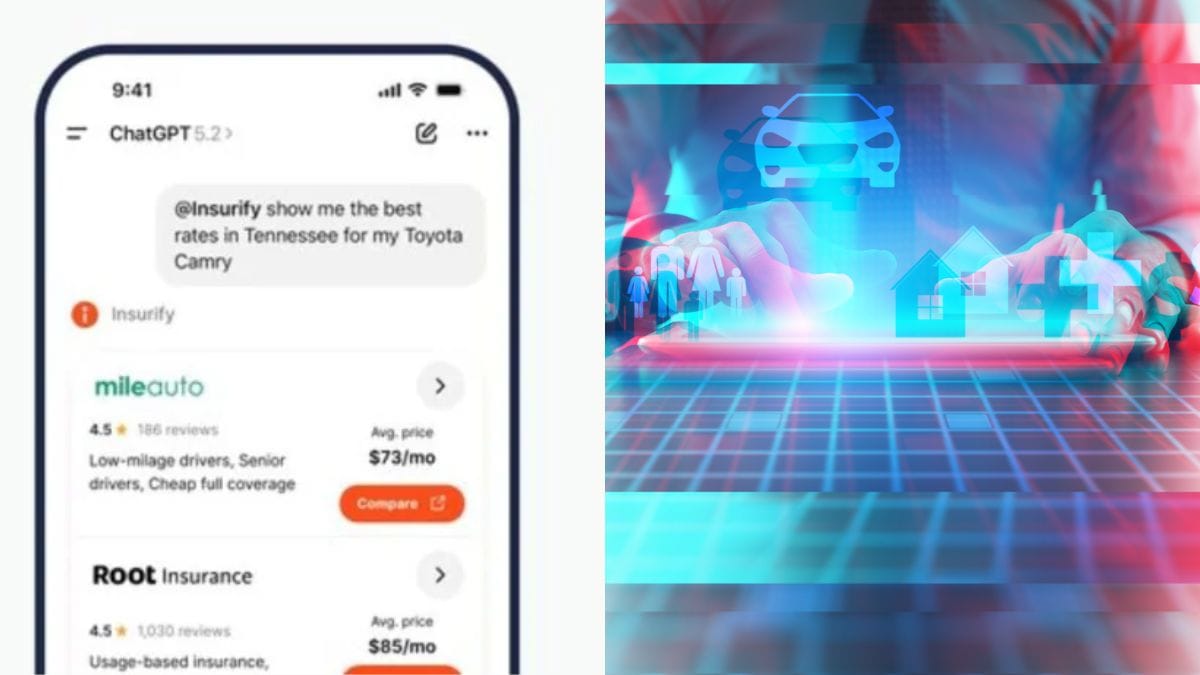

The recent decline in insurance broker stocks signals a significant shift in market perceptions of human-led service industries amidst the rapid advancements in AI technology. On February 9, 2026, Insurify launched its AI shopping agent, triggering a substantial market cap loss across the insurance sector. This followed AI innovations from Anthropic, impacting various industries from legal services to financial research, resulting in declines for companies like Expedia and Salesforce.

Prominent insurance firms such as Willis Towers Watson and Aon saw sharp stock drops of 12% and 9.3%, respectively, as investors reassessed the long-term viability of traditional brokerage roles. The rapid deployment of AI tools could indicate a broader industry reset, with 2026 marking a critical point where AI is seen as a direct revenue threat rather than merely a feature. The implications of this shift extend to multiple sectors, requiring a reevaluation of investment strategies in a changing landscape.

Source link