In the wake of a new AI tool from Altruist Corp., the wealth-management sector faces significant turmoil. Investors are growing apprehensive, leading to a sharp selloff in wealth-management stocks. This innovative tool personalizes tax strategies but raises concerns about the potential for AI to disrupt traditional financial advice.

Key Highlights:

-

Market Reaction:

- Raymond James fell 8.8%, its worst day since March 2020.

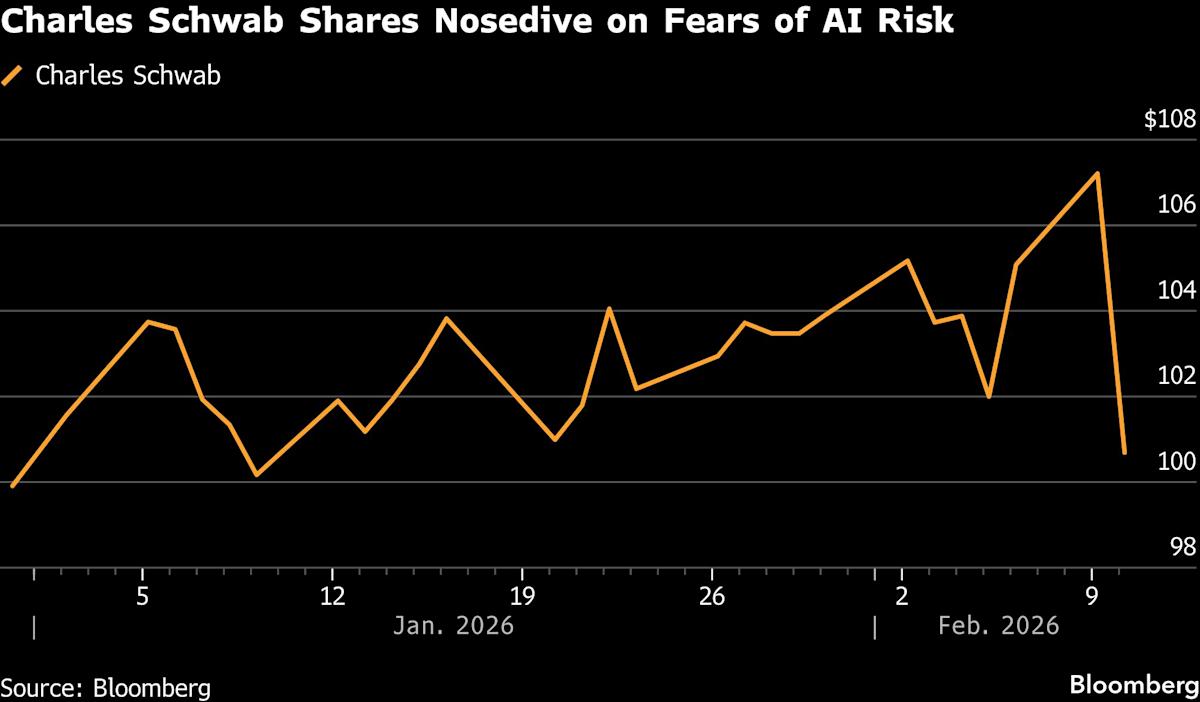

- Charles Schwab and LPL Financial also incurred substantial losses of 7.4% and 8.3% respectively.

-

Industry Impact:

- Fears of AI efficiencies leading to fee compression and market-share shifts.

- Investors are questioning the sustainability of human-driven advice.

-

AI’s Role:

- As AI continues to advance, its implications span various sectors, triggering selloffs in stocks tied to traditional business models.

Analysts suggest that much of the panic may be overblown, emphasizing the human element in financial services will remain essential.

📈 Join the conversation! Share your thoughts on how AI is reshaping wealth management and other industries.